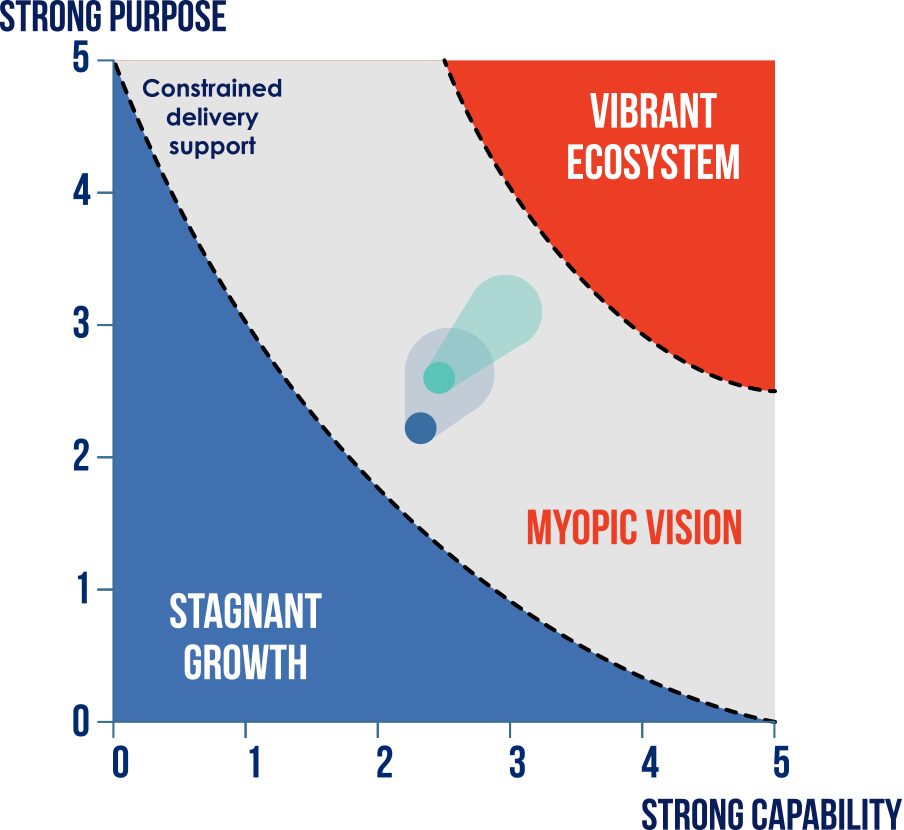

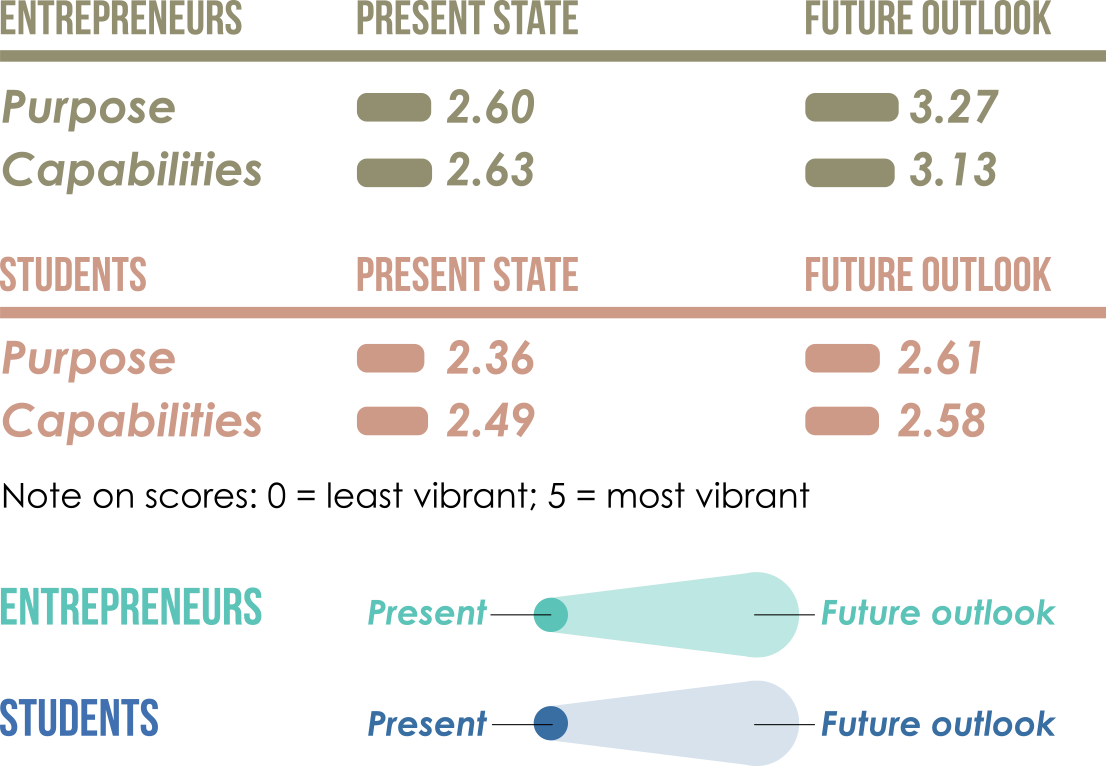

This second edition study examines the development of Hong Kong’s start-up ecosystem.

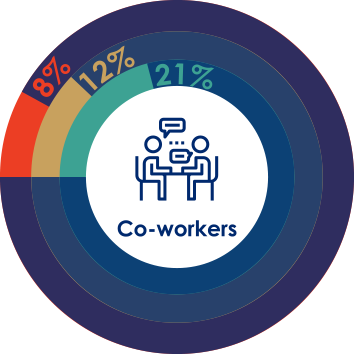

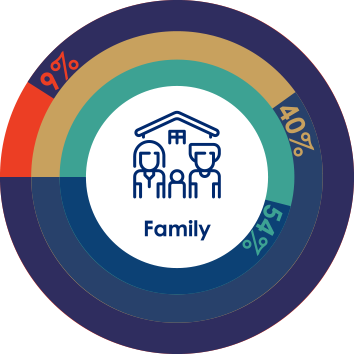

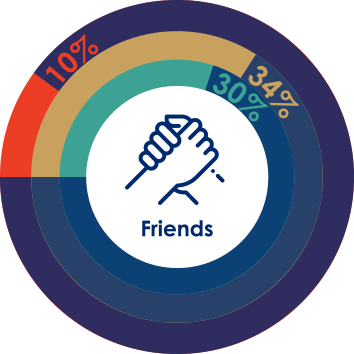

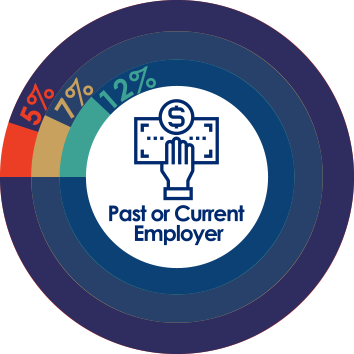

This year’s Transforming Hong Kong Through Entrepreneurship study finds that Hong Kong entrepreneurs are ambitious about the long-term growth prospects of their companies, are increasingly looking to expand their businesses outside of Hong Kong, and are making better use of available support services. However, growth may be constrained if support is not better targeted to the needs of start-ups as they progress from early to growth stage. In addition, more needs to be done to ensure that founders and those interested in working for start-ups receive sufficient support from family, friends and the general community.

More entrepreneurs surveyed agree Hong Kong is a dynamic and vibrant start-up location compared with last year, but additional targeted support for growth stage ventures and emerging sectors is needed

The study highlights differences in how entrepreneurs rated Hong Kong’s position as an innovation hub in key sectors. Respondents were more likely to consider Hong Kong as an innovation hub for the fintech sector compared to artificial intelligence, biotechnology or smart city, suggesting the latter sectors need more targeted support. More than two-thirds of entrepreneurs polled (67 percent) agree Hong Kong is well-positioned as a fintech innovation hub, compared with less than half who agree the same for the other three sectors.

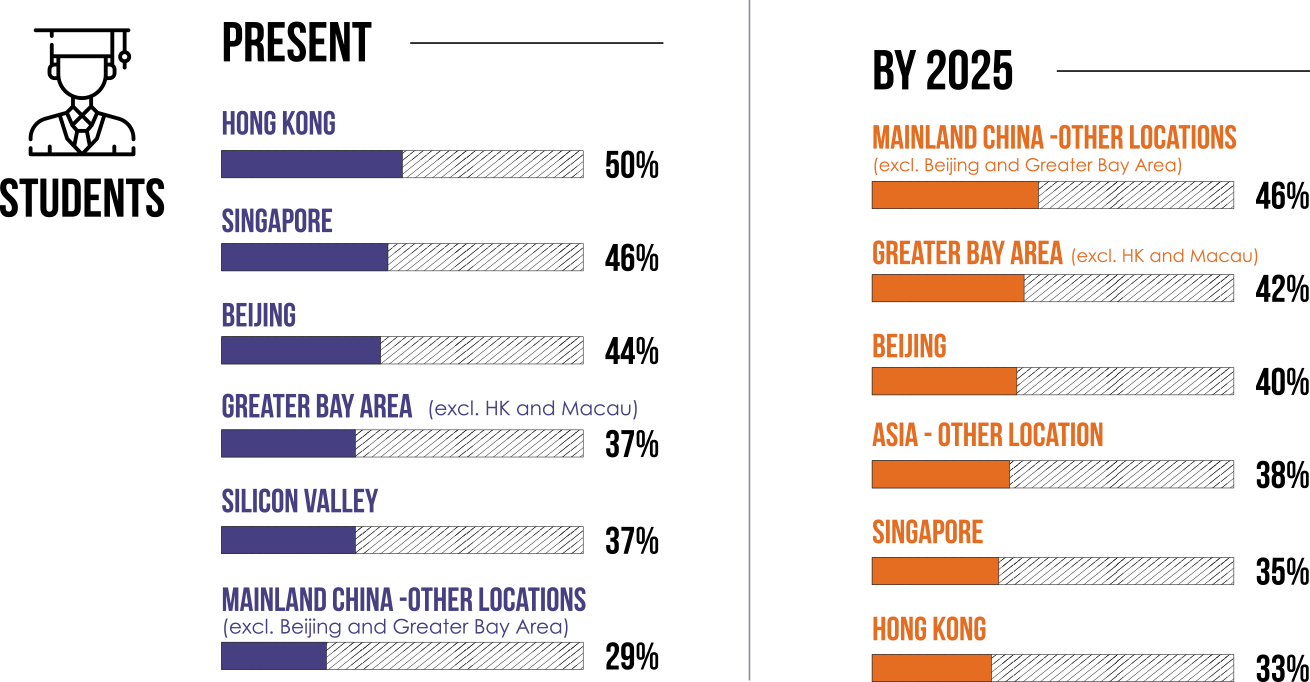

Students rank Hong Kong as their most preferred place to start a business, but this may shift by 2025 as mainland China’s tech hubs continue to develop

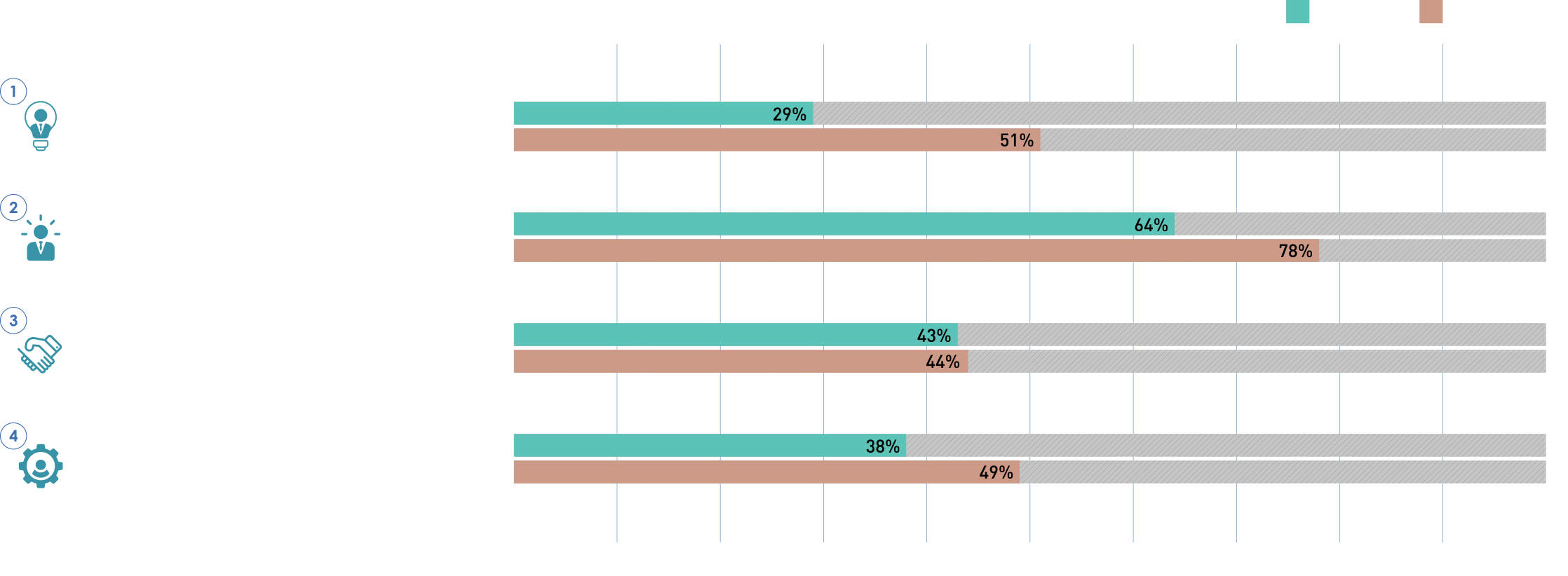

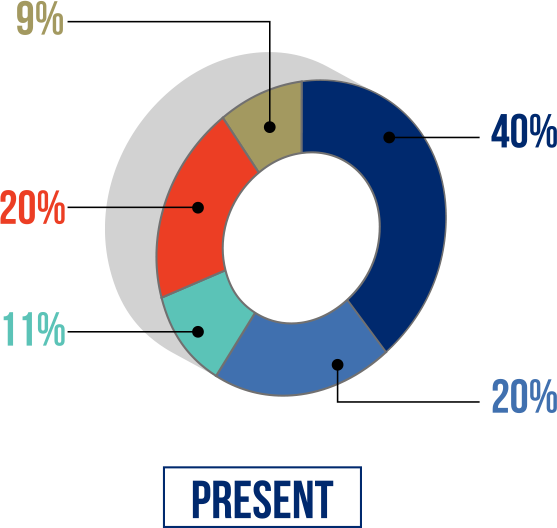

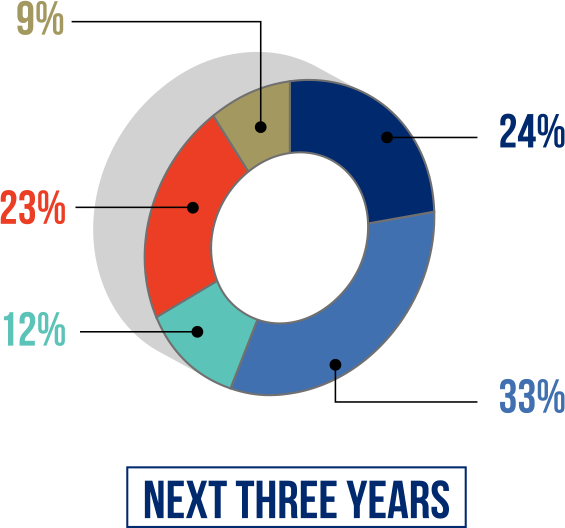

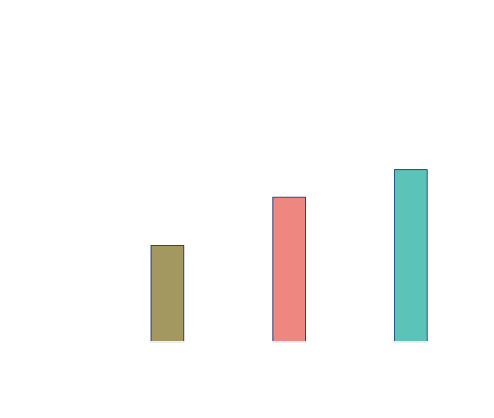

Percentage of entrepreneurs who selected each of the below responses as one of the top three challenges

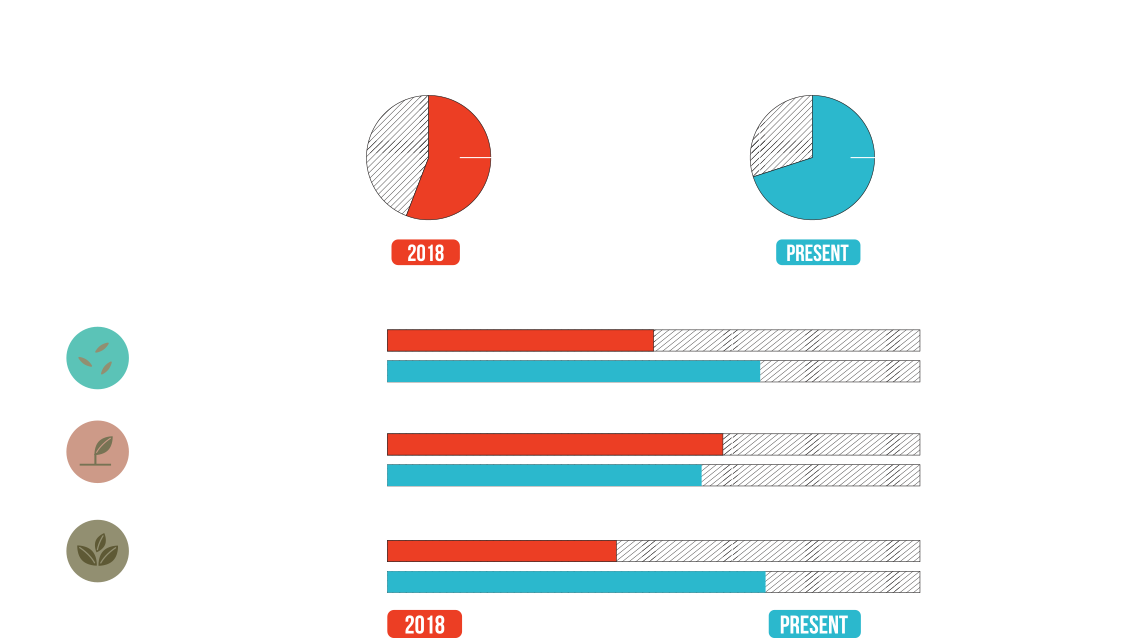

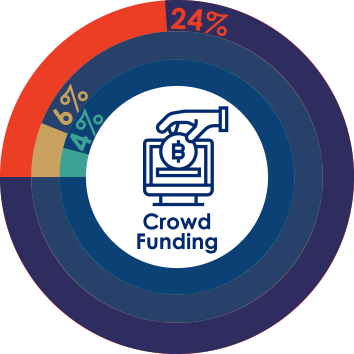

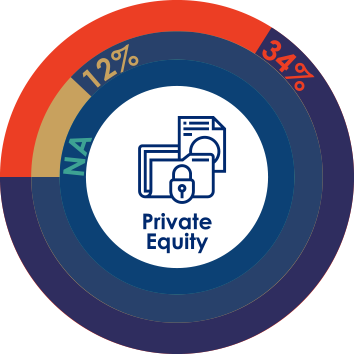

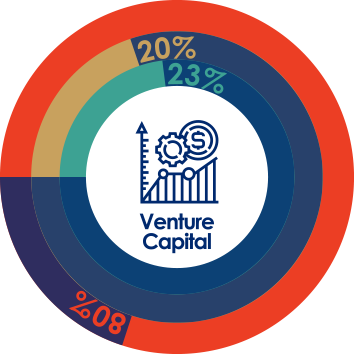

Start-ups expect to increase their use of formal funding sources, but more education is still needed to improve access to funding

Analysis of VC investment over the past six years highlights a 20-fold increase in capital directed at Hong Kong-based start-ups. Average deal size for private VC investments increased more than 35-fold within the same period. The findings suggest Hong Kong’s VC ecosystem is maturing and that priority innovation & technology focus areas including artificial intelligence, biotechnology, fintech and smart city azre gaining a greater proportion of the total capital invested.

Source: KPMG Survey Analysis

Note: respondents could choose all categories that apply. Data shows the percentage of respondents who use each funding source, not the value of funding. Reasons for not using private equity were not measured in the 2018 study.

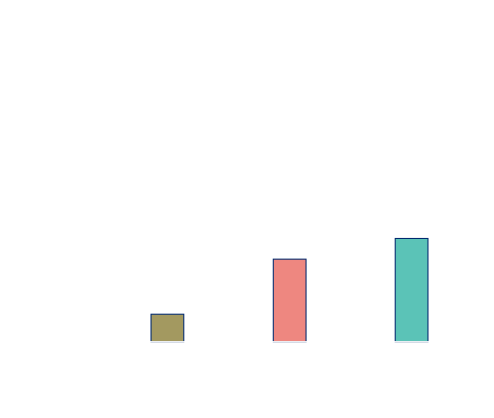

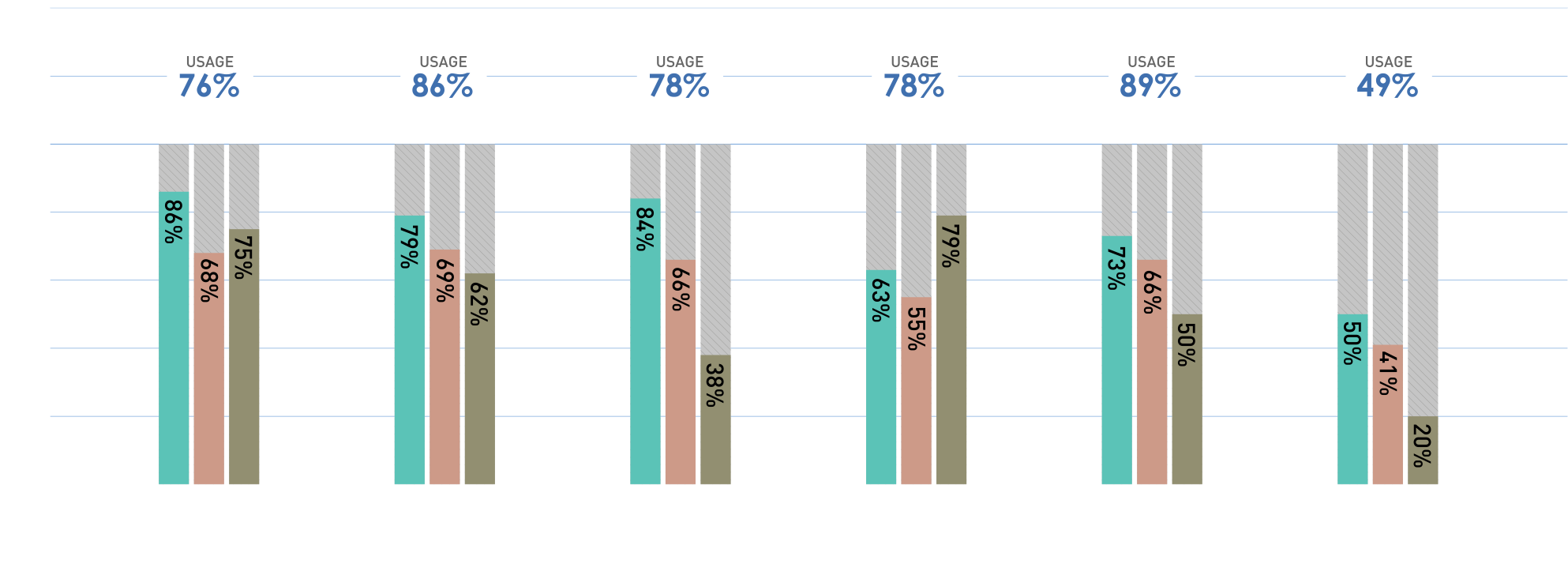

Use of support services is increasing, but gaps in effectiveness pose a risk to future vibrancy as start-ups move from early stage to growth stage

Overall, entrepreneurs are making better use of support services, such as co-working spaces, pitching competitions and mentoring, compared with a year ago. However, the use and the effectiveness of these services tended to be higher for early-stage start-ups as compared to growth-stage and mature-stage, suggesting a need for differentiated services targeted to post- prototype stage companies.

Percentage of entrepreneurs saying services are effective or very effective

Source: KPMG survey analysis

Note: Usage = percentage of respondents who say they use these services.

The talent picture is improving for Hong Kong start-ups, but more should be done to cultivate local talent and develop an entrepreneurial mindset

Percentage of entrepreneurs who agree or strongly agree with the following statements